Money 2020

Led Campaign Creative Direction and Rebrand

Overview

Designed and directed a visual campaign for Railsr’s Money2020 conference presence - guiding the company through a major rebrand, and producing foundational assets for current and future marketing.

Key Contributions

Led design end-to-end, owning outreach with vendors, aligning needs between stakeholders, and unifying brand identity across digital, print, and event channels.

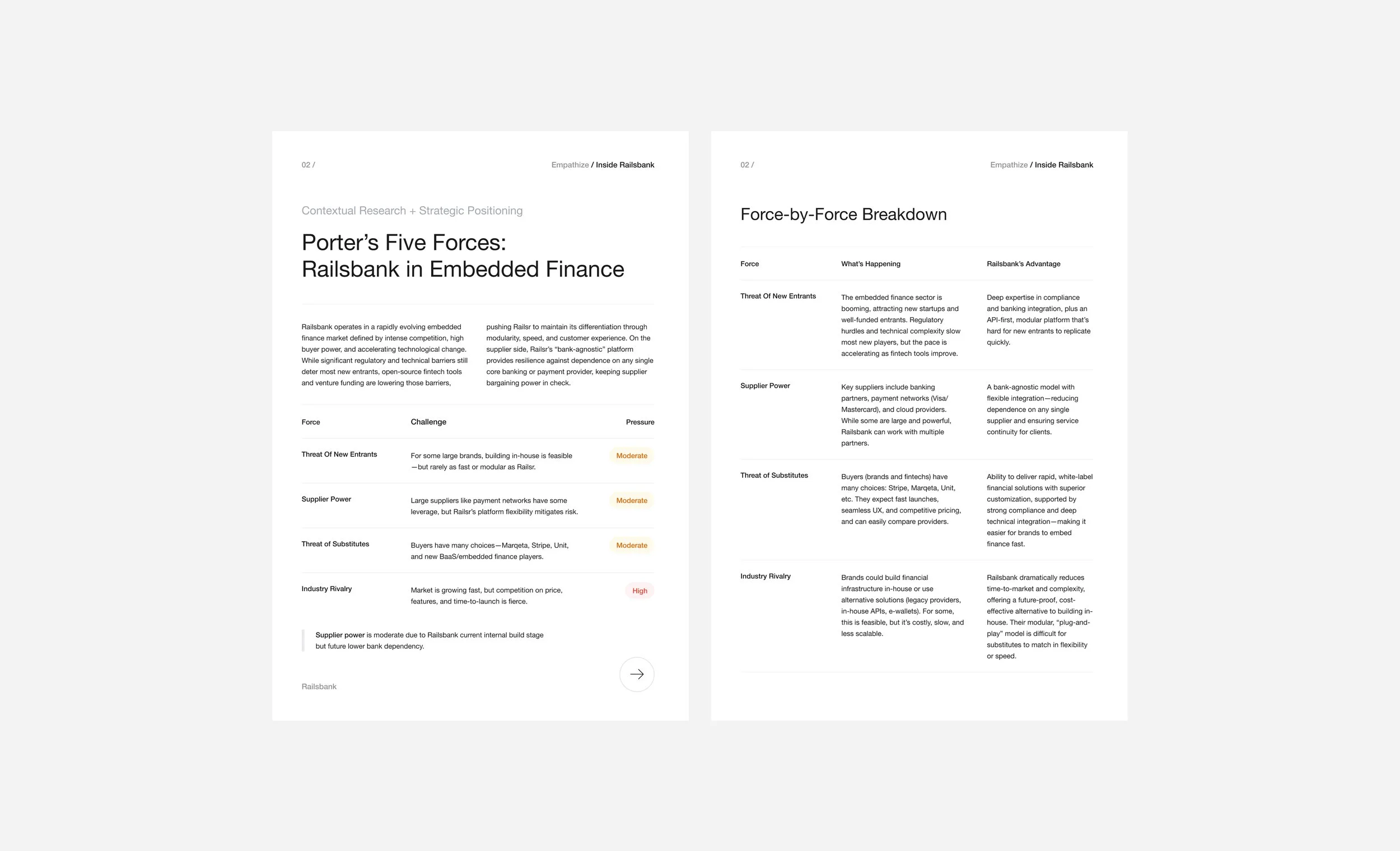

Defined Brand Positioning

Collaborating on category design research to clarify market-fit and unique product offerings.

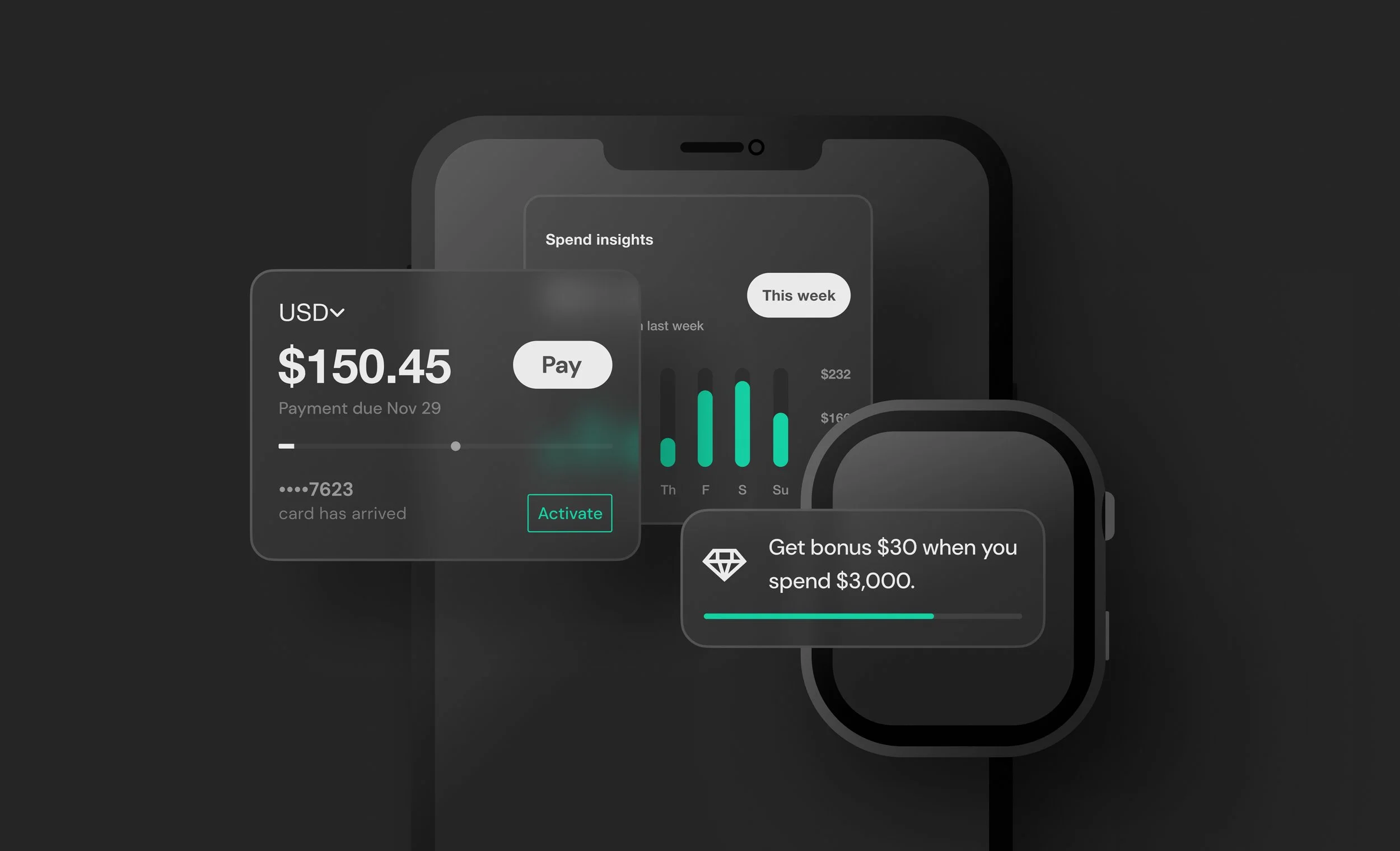

Visualized Product Offering

Created a visual “blueprint” that clarified Railsr’s value proposition for clients and partners.

Led Design of Campaign Assets

Designed assets and ensured consistency across mediums, delivering on a tight timeline.

Outcome

Positioned Railsr as a pioneer in Embedded Finance, driving 10+ sales leads and elevating brand credibility.

Design Brief

Drive leads through a multi-channel rebrand & campaign

—

including booth graphics, event marketing visuals, and merch.

The Challenge

Railsbank was midway through a rebrand led by an external agency with Money2020 approaching. With no insight into upcoming brand changes, I was called in to innovate on branding and visualize our product offering to drive sales leads.

We needed to define Railsbank’s value proposition to make the product offering memorable, no matter what the final branding would become.

This uncertainty gave me free rein to push beyond old conventions and lead a bold creative rebrand for the campaign.

Navigating ambiguity meant working closely with stakeholders to translate complex product layers into a clear, visual story.

Strategic Foundation

Discovery & Category Design Research

-

Railsr is the one-stop shop for embedded finance — offering a suite of turnkey financial products plus the full operational backbone (digital transaction ledger, legal compliance, banking partnerships) to launch them fast.

-

Railsr combines embeddable, pre-designed financial components with the behind-the-scenes infrastructure to run them, enabling brands to launch fully-branded financial experiences in record time.

-

Railsr serves digital-first brands, fintech startups, crypto projects, and large enterprises looking to embed financial services without building banking infrastructure themselves. Drivers: boost engagement, brand loyalty, etc.